Need to comply with FDIC Part 370 by April 2021?

Overwhelmed with Recordkeeping requirements brought on by regulation?

YES!

YES!

Need to comply with FDIC Part 370 by April 2021?

Overwhelmed with Recordkeeping requirements brought on by regulation?

YES!

YES!

You uphold plenty of regulations already!

Macro Financial’s Data Quality Services and the DICE system are customized to meet your Part 370 compliance needs!

Start Your Compliance Program

Assess Deposit Systems

Macro guides you through your journey, educating your organization on everything related to 370, 330, 360.9 while assessing record keeping rules at the same time during our Data Quality service.

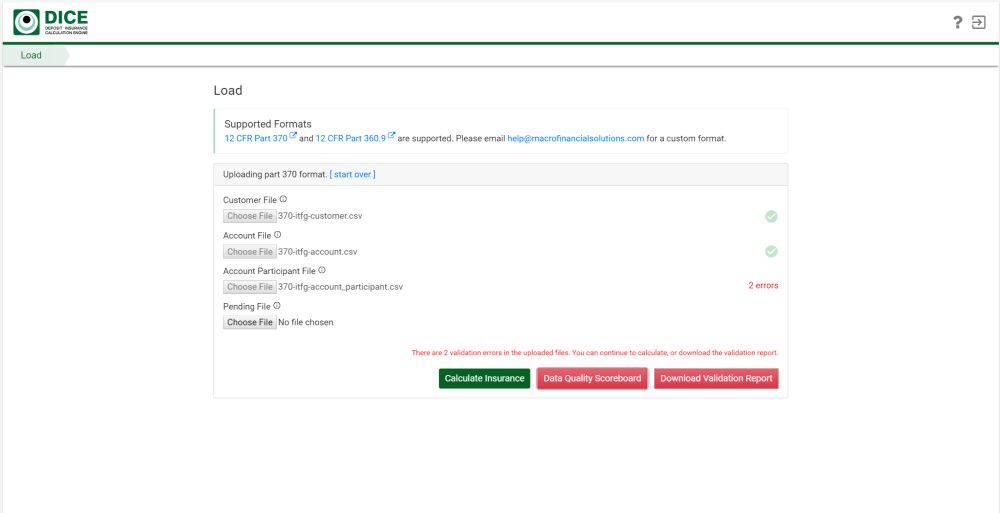

Load

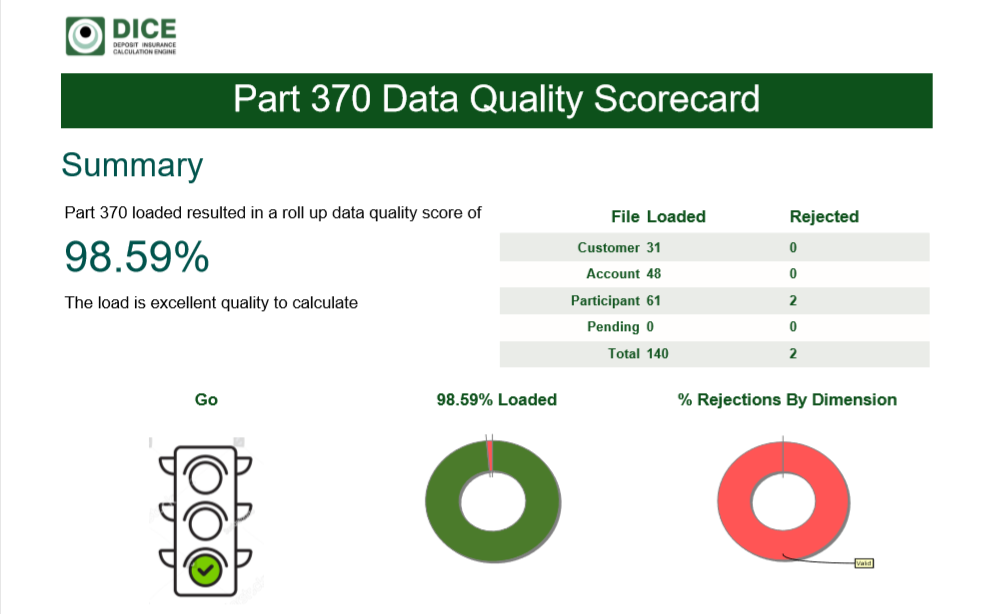

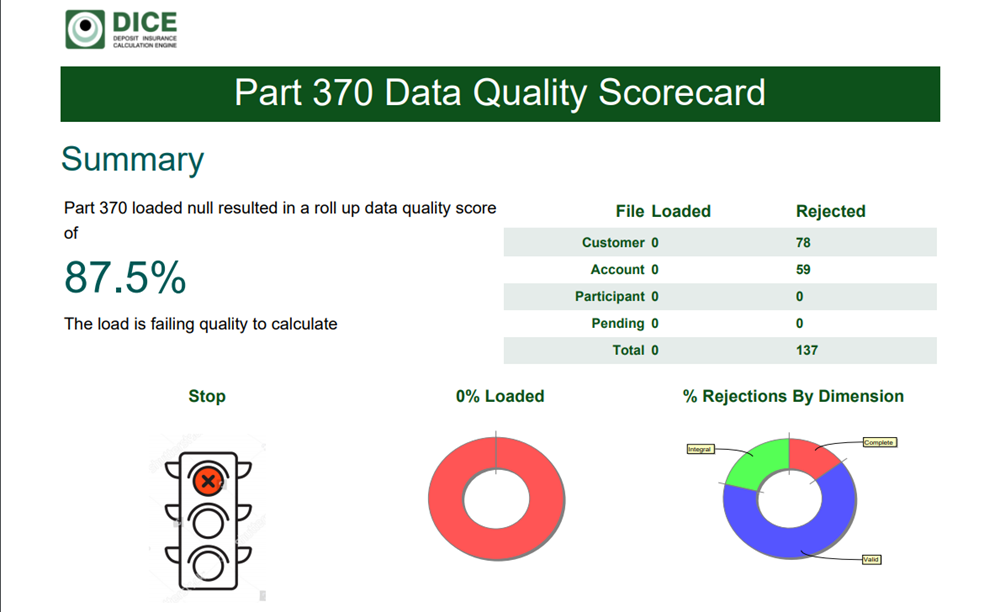

Should the unfortunate time come to close your institution or you are preparing for the FDIC annual 370 audit, the Deposit Insurance Calculation Engine (DICE) product loads your data in a fraction of the 24 hour window for processing.

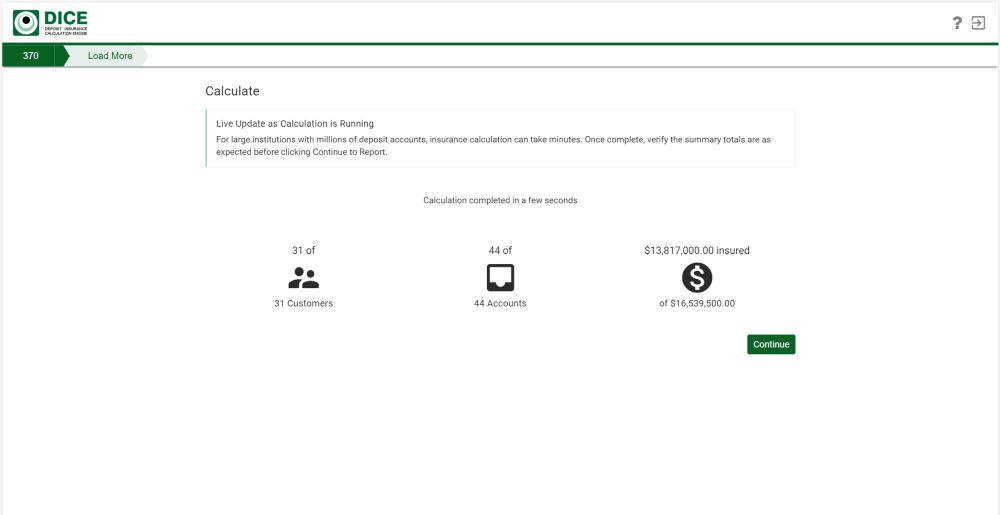

Calculate

Upon load, DICE performs calculation even faster than loading! Leave the complex rule logic to us while you worry about another regulation.

Reload

DICE supports multiple Pass Through Entity (PTE) loads accepting the FDIC Deposit Broker Input Format. Next, continual loading of 360.9 and 370 will be enabled, allowing for the initial data set’s quality to improve across all accounts on each load!

Correct Data

Together, whether through preventive or corrective action, our Data Quality specialists not only consult you on what it takes but also lead the Data Management team in meeting 370’s record keeping compliance rules.

Certify Compliance

After calculation by DICE, you have all the output files you need to certify compliance. Continuing forward as a champion meeting compliance efficiently.

User Experience (UX) Redesign: Currently mobile first (Yes, DICE works on iPads!), the loading and calculation screens will be enhanced to leverage desktop resolutions, showing many more features, widgets, and gizmos on screen.

Macro has developed and maintained numerous internal systems for government agencies where IT governance and processes are highly formalized, reported, and reviewed. We have the expert knowledge you need to meet government regulations.